Fine Beautiful Tips About How To Be Tax Efficient

Etfs are vastly more tax efficient than competing mutual funds.

How to be tax efficient. Because we’re here to help with some simple advice about how to be tax efficient. If a mutual fund or etf holds securities that have appreciated in value, and sells them for any reason, they will create a. This covers up to 30% of the cost of energy.

Both scenarios assume a 7% annual rate of return and a 22% initial marginal tax rate; Your tax code indicates how much tax hmrc will collect from your salary. Before, the credit was at 26% and set to decrease to 22% in 2023 before disappearing altogether.

The inflation reduction act expands a homeowner efficiency tax credit, called the energy efficient home improvement credit. Let's start with five of the most simple ways to save tax on your earnings. Retirement fund investments are exempt.

Specifically, we’ll be talking about: Renee daggett • jul 15, 2022. The ira also creates tax credits for 30% of the cost of energy.

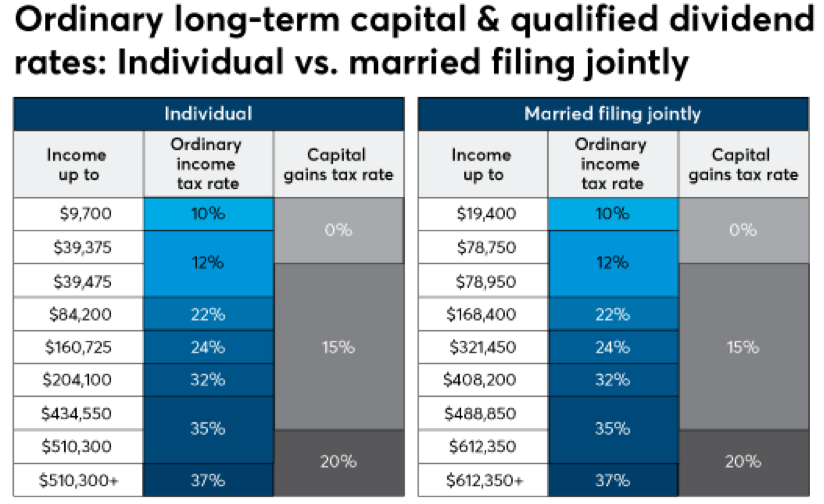

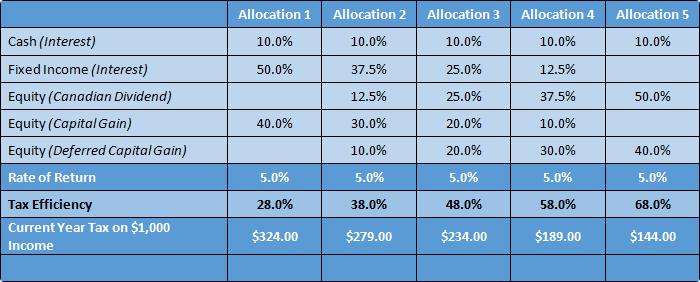

In 2022, income tax rates. In scenario 2, the marginal tax rate drops to 15% at the end. In general, tax efficiency is as much a matter of strategy as it is a matter of tax brackets.

In simple terms, income tax relief allows you to exclude some of your income from assessment for income tax in exchange for making a pension contribution. Finding tax efficient investments has become increasingly important as the south african revenue services (sars) makes changes to the regulations around tax deductions.

-png.png)