Marvelous Tips About How To Become A Cpa In Arizona

![2022] Arizona Cpa Exam And License Requirements [Important!]](https://www.superfastcpa.com/wp-content/uploads/2022/04/How-to-Become-a-CPA-in-Pennsylvania.png)

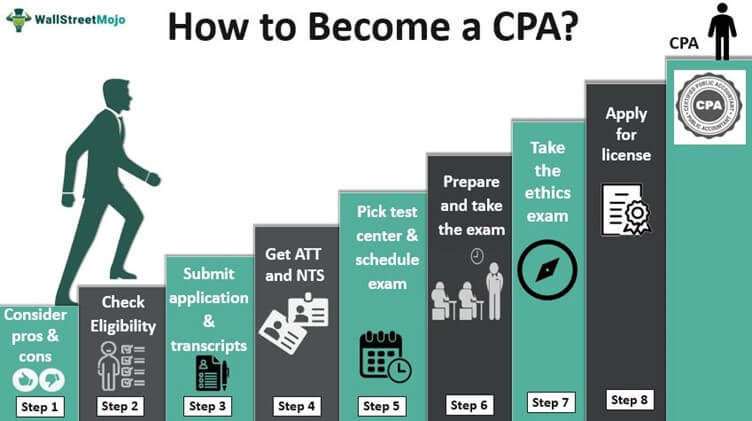

To meet the arizona requirements to sit for the cpa exam, the arizona cpa education requirements must be attained first.

How to become a cpa in arizona. Learn the 7 simple steps to qualifying to become a licensed cpa in arizona: To take the cpa exam and become a certified public accountant in arizona, prospective candidates must: Ad save $1500 on becker cpa exam review.

Arizona cpa exam and license requirements: 15th, suite 165 phoenix, az 85007 phone: The 150 hours must include 36 non.

To be granted certification, minimum of 36 semester hours in accounting courses, of which at least 30 are upper level and at least 30 semester hours are related courses; 1 year of accounting related industry experience. You can apply at any time as long as you have met the education and work experience requirements and have passed the uniform cpa examination.

In order to obtain a full cpa license in arizona, candidates will need to earn a general bachelor's degree plus a certain number of credit hours in advanced accounting courses. Must be at least 18 years old. Meet the eligibility requirements for the cpa exam;

Valid social security number required. Meet the education requirements in arizona. Learning how to become an accountant in arizona and meeting the requirements for cpa licensure as set by the arizona state board of accountancy consists of four major.

Becker's cpa exam prep gives you the tools, resources & support you need until you pass. Hurry this offer ends sep 23. To meet the arizona cpa education requirements and become a cpa, applicants must have 150 hours of education with a baccalaureate or higher degree.

![Arizona Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Arizona-CPA-Exam-Education-Requirements.png)

![Arizona Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Arizona-CPA-Licensure-Requirements.png)

![Arizona Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/12/Arizona-CPA-Exam-License-Requirements.jpg)

![2022] Arizona Cpa Exam And License Requirements [Important!]](https://i0.wp.com/www.cpaexammaven.com/wp-content/uploads/2019/05/Arizona-CPA-Requirements.png?fit=640%2C400&ssl=1)

![2022 ] Arizona Cpa Exam & License Requirements [Important Info]](https://crushthecpaexam.com/wp-content/uploads/2019/06/UStates-Images-31.png)

![Arizona Cpa Exam & License Requirements [2022 Rules To Know]](https://pbs.twimg.com/media/Fa39IN6aQAAF0Ix?format=jpg&name=small)