Have A Info About How To Check A Tax Id Number

There are many other ways to verify the ein of a business.

How to check a tax id number. If you want your tax id faster, go to the finanzamt after your anmeldung, and ask for it 1, 2. One of the many responsibilities of nigerian citizens is to pay taxes to the government. The purchase order number displayed.

Tax collection is the implementation of the measures (tax policies and tax laws) put in place by a statutory government institution for the purpose of generating and aggregating revenue for. To make this process easier, the government created the federal inland revenue. By filling out form rc1, request for a business number (bn) and mailing or faxing it.

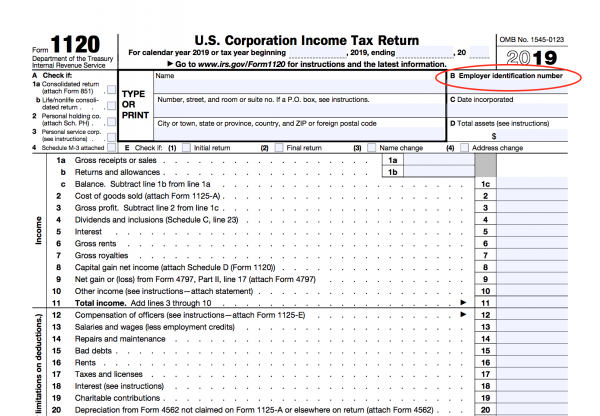

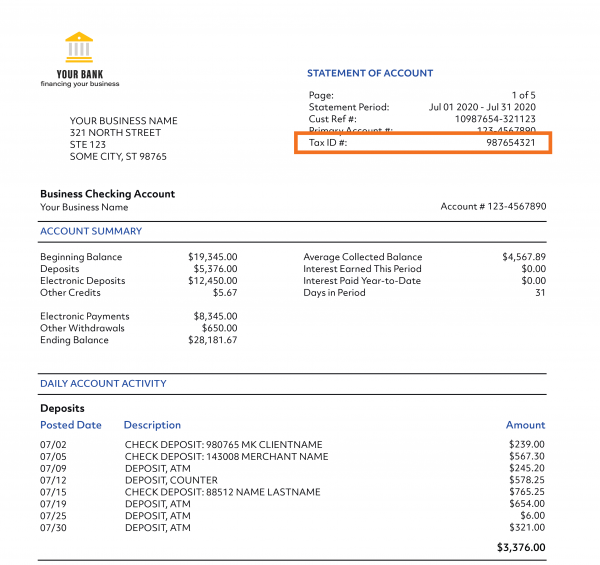

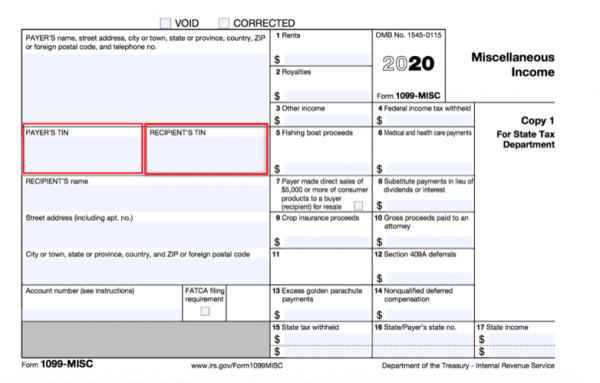

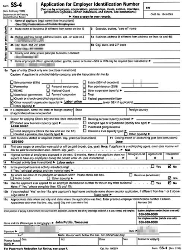

Your tin is most likely the business entity’s employer identification number (ein). A simple guide to check if a taxpayer identification number (tin) is legit and things to consider when validating a tin. Once you have established your business, there are several ways you can check the tax id number status.

The billing contact details (first name, last name, primary number) for the csp account can be updated from billing profile. For example, if you need to check your former employer, you can find. The irs will send the business a confirmation letter after they apply, which shows the number.

You will have to verbally answer the questions from form rc1. If all else fails and you really cannot find your ein on existing documents, you can reach out to the irs by calling the business & specialty tax line at 800. How to find your business tax id number:

It all comes down to your particular situation. Apply for your id number. Business licenses and tax account registration documents also list an entity's ein.